Real Assets

We build future energy systems and resilient infrastructure, backing emerging opportunities in technology, land and water.

Real Assets

Private Equity & Ventures

Real Assets

Private Equity & Ventures

Ross Driver recently presented Foresight Solar’s total shareholder return (TSR) strategy at the Stifel Infra & Renewables Seminar.

Ross Driver recently presented Foresight Solar’s total shareholder return (TSR) strategy at the Stifel Infra & Renewables Seminar. He explained how it’s an “and” approach, with FSFL targeting an element of net asset value (NAV) growth on top of the fund’s sustainable, progressive dividend policy.

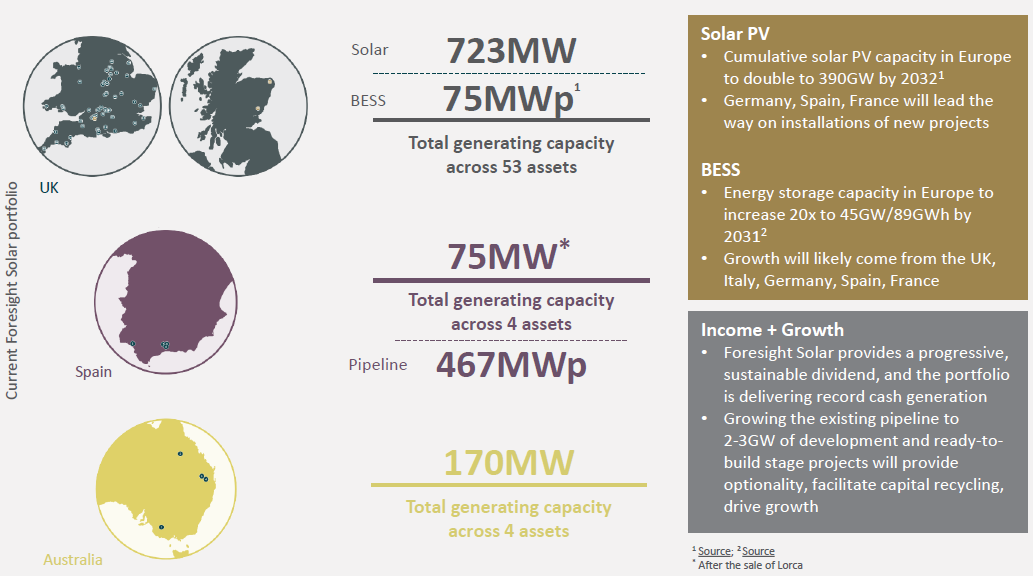

With the operational portfolio reliably producing electricity and generating cash, the opportunity will come from building out the existing c.500MW pipeline to up to 3GW of development and ready-to-build-stage projects that are able to provide optionality, facilitate capital recycling and drive growth.

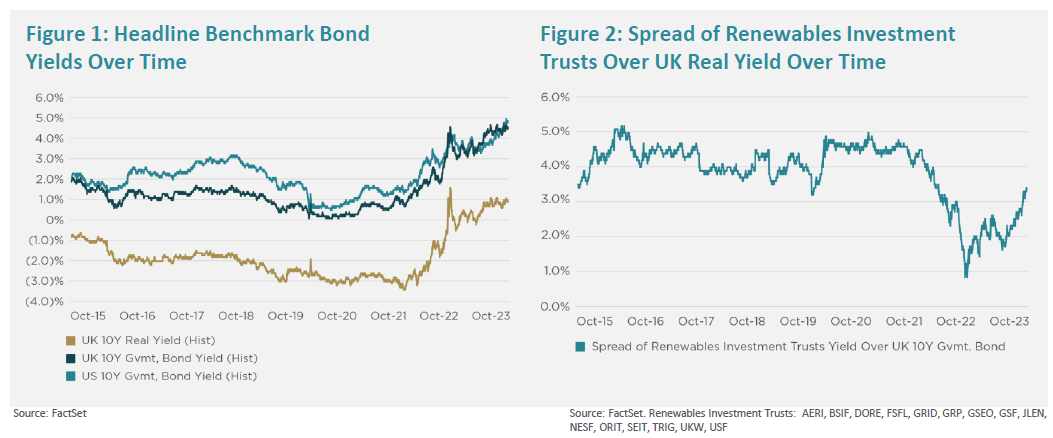

Changing macro environment has direct read across to real assets

Rapid rise in yields has eroded the spread in return offered by renewables

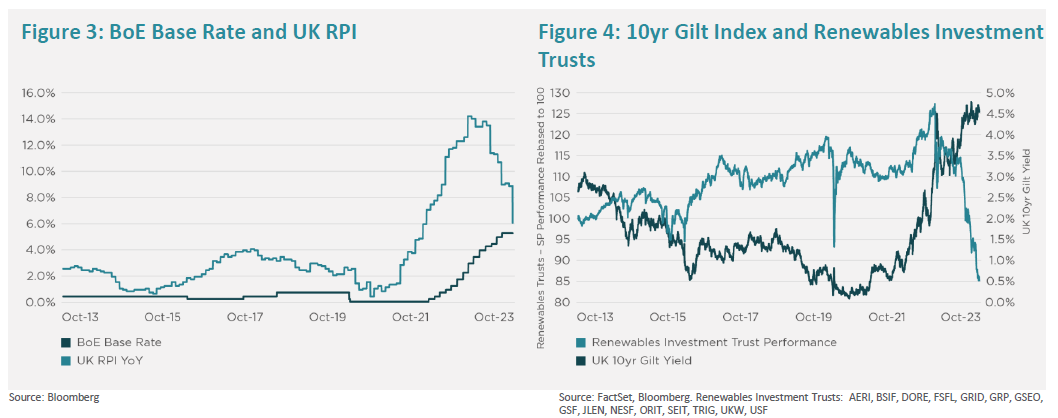

Negative correlation between surging gilt yields and investment company share prices

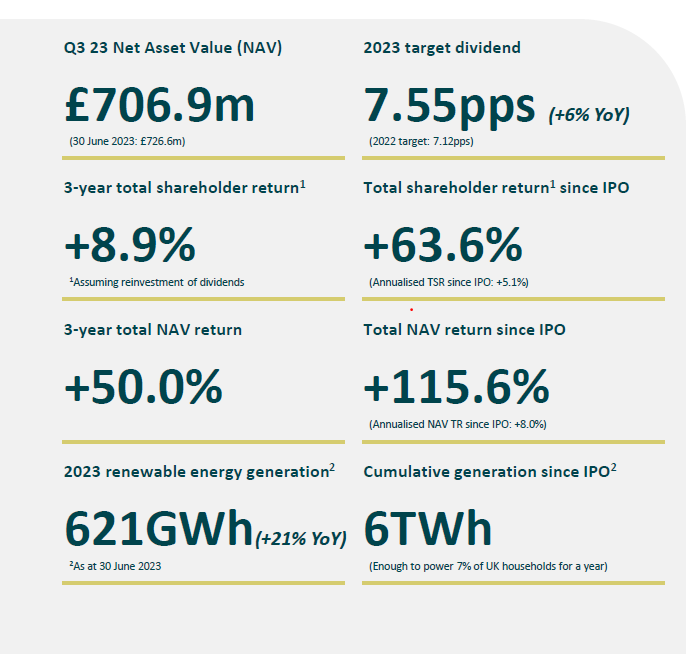

Foresight Solar Fund: Snapshot as at Q3 2023

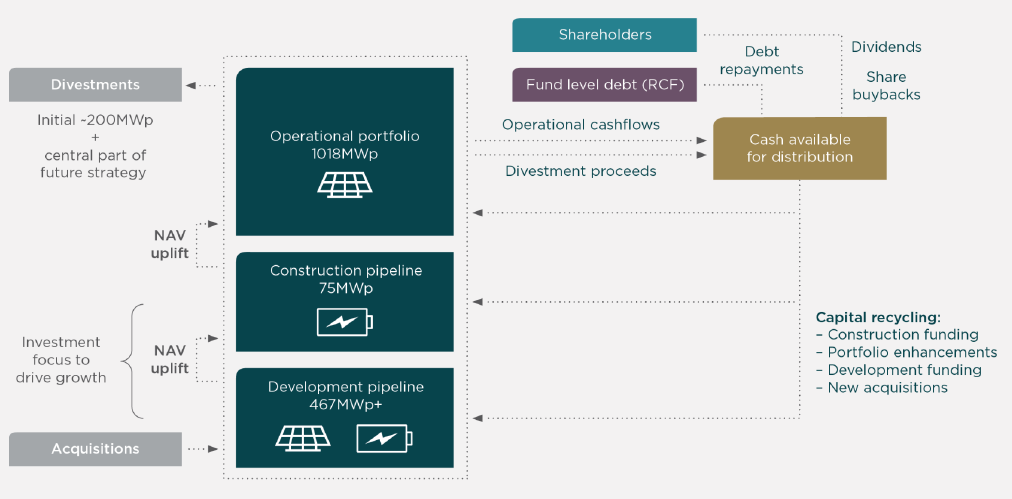

Total Return focus viewed through a combination of fund actions

Financial outlook:

FY dividend target of 7.55pps on track

1.5x target net dividend cover until at least 2025

Capital allocation

FSFL approach to capital allocation is centred on income AND growth

Strategy involves prudence, focus on return accretion and optionality

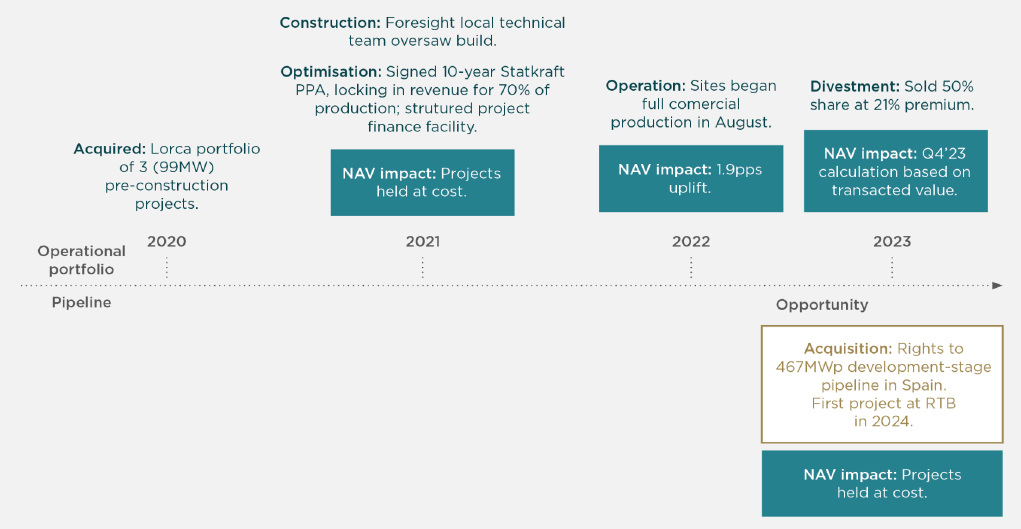

Case study: Lorca construction, optimisation and partial exit provides multiple uplifts

Demonstrable track record of bringing assets through construction is key

Future growth: Building a strong, diversified pipeline across multiple markets

UK and Europe provide significant opportunities in solar PV and BESS

You have viewed 0 of 0