Real Assets

We build future energy systems and resilient infrastructure, backing emerging opportunities in technology, land and water.

Real Assets

Private Equity & Ventures

Real Assets

Private Equity & Ventures

Senior Investment Manager Seth Hoskins explains how an ageing population is creating a demand wave for senior housing accommodation shifting a traditionally defensive sector to one with growth characteristics.

Senior housing communities provide independent, assisted living and memory care accommodation options for elderly retired people i.e. residents that are typically 80+ years old. In the U.S. the model is almost entirely private pay, with customer payments out of pocket rather than government funded, reducing regulatory risk for investors.

Senior housing REITs own the underlying asset and appoint an operator to run day-to-day operations of the community, covering areas such as staffing, care services, and meals. The sector mostly operates under the structure in which the operator is paid a management fee, and the asset owners (the REIT) participates in the underlying profitability i.e. revenues from resident rent less operating costs and a management fee.

Senior housing communities offer residents a sense of community, reducing isolation and loneliness that can occur when ageing in home. Regular physical exercise classes and group activities additionally support both positive physical health and emotional wellbeing outcomes. As demand for high-quality accommodation for the elderly continues to grow rapidly, senior housing communities can provide social benefits and positive health outcomes relative to ageing in place. Moreover, this can aid in reducing overall healthcare costs which are attached to hospitals and long-term care in traditional rest homes settings.

Underpinned by a cyclical post-COVID earnings rebound, U.S. Senior housing companies including Welltower, Ventas and American Healthcare REIT have delivered exceptional total shareholder returns, meaningfully outperforming REIT peers, as represented by the All-REIT Index, as well as the S&P 500 (Figure 1).

Figure 1: Source: Bloomberg 12th December 2025, Foresight Capital Management, All-REIT is FNER Index.

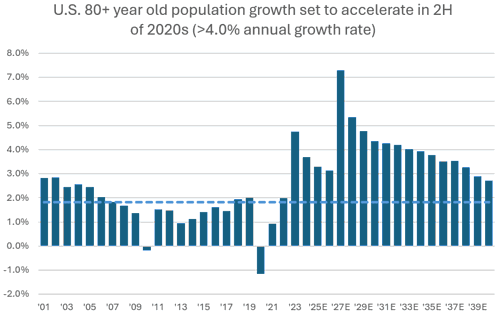

The first cohort of baby boomers is expected to reach 80 years of age in 2026, marking the beginning of the “silver tsunami.” U.S. Census projections indicate that the population aged over 80 years old is forecast to grow at a ~4% annualised growth rate between 2025-2040, compared with <2% over the prior two decades (Figure 2). In absolute terms, this equates ~90,000 units of new units required per annum at historic penetration rates (i.e. proportion of 80+ year olds in retirement communities).

Figure 2: Source U.S. census data, Greenstreet research.

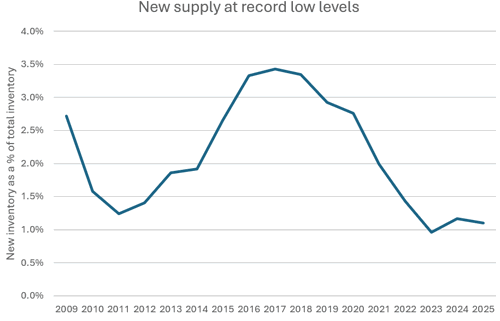

As demand reach new highs, annual new supply is running at historic lows of 1% of existing stock (Figure 3).

Figure 3: Source Greenstreet, Foresight Capital Management.

Strong demand and constrained supply are creating multiple drivers of growth for the sector.

A durable mismatch between demand and supply indicates occupancy is likely to continue to rise over the medium-term (Figure 4). While a supply response is inevitable there are inhibiting factors currently constraining new supply for the next 2-3 years. Elevated construction costs following the inflationary period during COVID, together with tighter development financing conditions, have increased the hurdle rates required for new projects. In the meantime, rents will need to rise to support meaningful new supply.

Figure 4: Source Company reports, Foresight Capital Management.

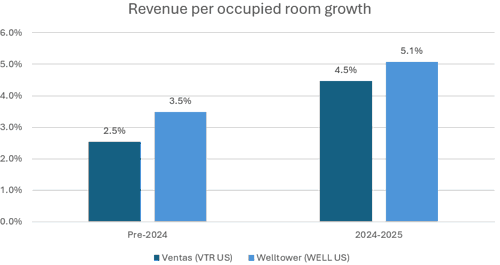

Senior housing communities tend to exhibit greater pricing power at higher levels of occupancy. Residents tend to prefer to stay within their local area, and higher occupancy indicates both quality and a lack of available substitutes in that local catchment. Across FY24-25, revenue per occupied room (RevPOR), which is the proxy for pricing, has grown at ~5% versus the long-term trend growth level of ~3% (Figure 5). With occupancy positioned to increase, we expect landlords to continue to exhibit strong pricing power.

Figure 5: Source Company reports, Foresight Capital Management.

Staff costs are the largest expense for senior housing companies, representing ~70% of total costs. Once occupancy reaches 90%, communities are effectively fully staff meaning staff costs tend not to increase materially with each new unit occupied. This allows incremental units occupied to generate operating margins of 50-70% versus group margins of 25-30%. With sector occupancy currently at 88% and trending higher, operating margins are well-positioned to expand over the medium-term.

Alongside positive operating fundamentals, attractive acquisition returns have supercharged portfolio expansion and earnings growth. US REIT Welltower has acquired a staggering >US$15bn in assets since 2022. Senior housing operators have outlined large pipelines and little erosion in acquisition returns, highlighting this as a core driver of portfolio and earnings growth ahead.

The senior housing sector highlights the benefits that structural growth thematics can deliver for investors with strong demand creating multiple sustainable drivers of cash growth. Collectively these drivers are reflected in Bloomberg consensus estimates which highlight an expectation for double-digit cash flow per share growth per annum over the next three years. This means despite the already strong total shareholder returns delivered in recent years, senior housing remains well-positioned looking ahead.

Seth Hoskins

Senior Investment Manager

Foresight Capital Management

For further information, please get in touch with your regular Foresight contact or the client team on the details below:

Foresight Group LLP does not offer legal, tax, financial or investment advice and the information on this website should not be construed as such. We recommend investors seek advice from a regulated financial adviser. The opportunity described in this document may not be suitable for all investors. Any such investment decision should be made only on the basis of the Fund scheme documents and appropriate professional advice.

Foresight Group LLP acts as investment manager and is authorised and regulated by the Financial Conduct Authority with Firm Reference Number 198020 and has its registered office at The Shard, 32 London Bridge Street, London SE1 9SG.

OEICs

An investment in FP Sustainable Future Themes Fund, FP Foresight Global Real Infrastructure Fund, FP Sustainable Real Estate Securities Fund, FP UK Infrastructure Income Fund or FP WHEB Sustainability Impact Fund and Liontrust Diversified Real Assets Fund (together the “Funds”) should be considered a long-term investment that may be higher risk. Portfolio holdings are subject to change without notice.

The Authorised Corporate Directors FundRock Partners Limited (registered office at Hamilton Centre, Rodney Way, Chelmsford, England, CM1 3BY) and Liontrust Investment Partners LLP (registered office 2 Savoy Court, London WC2R 0EZ), are authorised and regulated by the Financial Conduct Authority with Firm Reference Numbers 469278 and 518552 respectively. The Funds are incorporated in England and Wales.

ICAVs

An investment in the WHEB Sustainable Impact Fund and the WHEB Environmental Impact Fund (together the “Funds”) should be considered a longer-term investment that may be higher risk. Portfolio holdings are subject to change without notice.

The Manager of the Funds is FundRock Management Company S.A., authorised and regulated by the Luxembourg regulator to act as UCITS management company and has its registered office at Airport Center Building, 5, Heienhaff, L-1736 Senningerberg, Luxembourg.

We respect your privacy and are committed to protecting your personal data. If you would like to find out more about the measures, we take in processing your personal information, please refer to our privacy policy, which can be found at http://www.foresight.group/privacy-policy.