Real Assets

We build future energy systems and resilient infrastructure, backing emerging opportunities in technology, land and water.

Real Assets

Private Equity & Ventures

Real Assets

Private Equity & Ventures

In the US especially, actions taken by President Trump1 are forcing companies to retreat on DEI commitments. For example, Novo Nordisk, a Danish pharmaceutical company held in WHEB’s health theme, is amongst 2002 of the largest corporates to have recently dropped senior management gender diversity targets in the US (Figure 1)3.

According to Novo, ‘changing legal requirements’ – US government investigations into alleged illegal DEI practices in federal agencies, and now also the private sector, – threaten eligibility for Contacted Medicare & Medicaid Services (CMS), which represent over 20% of its US business.

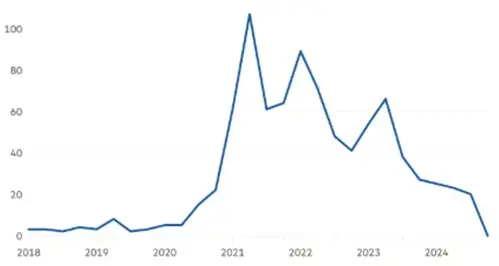

Figure 1: Conversations about DEI between companies and investors are in decline4

And it’s not only legal recourse corporates are wary of. Robby Starbuck, a conservative commentator called for a boycott of John Deere, which is held in an FCM fund5, for going ‘woke’ with its DEI-focused policies (Figure 2). Given the brand’s deep cultural resonance in rural, conservative America, Deere subsequently withdrew support for Pride parades, audited internal training materials to remove ‘socially driven content’, and clarified its position on diversity quotas and pronoun policies.

Figure 2: Conservative commentator calls out John Deere for ‘going woke’.6

We believe this moment reflects the Gartner Hype Cycle, where enthusiasm for new ideas often gives way to disillusionment before stabilising. The rise of DEI initiatives peaked around 2019–2020, driven by gender quotas and racial justice movements, with major financial institutions backing diversity through policies and practices, marking ‘peak hype’. Mapping Figure 1 to Figure 3 suggests we’re in the disillusionment phase amid backlash.

Figure 3: ‘DEI’ in the Gartner Hype Cycle’s zone of disillusion?7

But reaching the “new normal” requires a pragmatic view of the situation. Amidst the ideological push back, the business case for DEI has been further weakened by poorly implemented initiatives, sparking concerns about reverse discrimination8, and recent (justified) critiques of the research often used to justify action on DEI9.

As a response, scrapping DEI initiatives altogether would be a significant step backwards. Instead, we must learn from where the concept has failed and then to adapt approaches to better achieve the outcomes sought, as these are what matter.

And appetite for ‘DEI 2.0’ is there, even if it needs a rebrand.

Returning to our example of John Deere, its 2025 AGM became somewhat of a battleground with a counter-boycott launched by customers from the National Black Farmers Union10 and shareholder proposals filled on both sides. But pro-DEI investor sentiment prevailed with almost 30% (including FCM) voting in favour of an independent civil rights audit11 while anti-DEI proposals drew less than 1.5% support12,13.

Similar outcomes were seen at Disney, Goldman Sachs, Levi’s, and Coca-Cola’s AGMs and one study suggests shareholder support for workforce diversity in this proxy season was as high as 98%.14

For many corporations, improved firm performance has been the primary motivation for pursuing DEI initiatives, with broader societal benefits seen as a welcome bonus.

Encouragingly, a growing body of credible research is now linking firm performance to aspects of cognitive diversity15 and employee satisfaction16, both of which align closely with DEI principles.

These findings are significant in today’s political environment, where legislative efforts are underway to redefine materiality and challenge the compatibility of ESG considerations with fiduciary duty17.

Given our broader exposure to US listed companies, we’re adapting our engagement strategy.

Despite recent US policy changes, Novo Nordisk’s global DEI approach remains strong. The company has reaffirmed its target of 45% women in senior leadership by 2025 and continues to embed DEI through the ‘Novo Nordisk Way’. We therefore aim to prioritise resources for engagement on DEI elsewhere.

In our post-AGM engagement call with Deere, the company clarified that its inclusion efforts are ongoing but are being reframed to maintain impact while avoiding political sensitivities. This will be a challenging balancing act and we intend to support the company by sharing emerging evidence on how inclusive practices drive performance.

WHEB’s diversity matrix (Figure 4) remains a useful tool to identify engagement priorities. For example, Xylem, in the WHEB strategy’s Water Management theme, performs well in terms of ‘management priority’, but less so on the key performance indicator of senior gender diversity. We aim to explore how the company will respond to the evolving US context and will share research linking cognitive diversity, psychological safety, and performance.

In contrast, Advanced Drainage Systems, which is held in WHEB’s Environmental Services theme continues to underperform on both gender diversity and management priority. Consequently, we will consider shifting the conversation away from DEI terminology and instead focus on the core principles of high-performing teams, supported by evidence and aligned with long-term value creation.

Figure 4: Mapping gender diversity priorities within the FP WHEB Sustainability Impact Fund18

The current backlash against DEI marks not an end, but a transition. We believe that the route forward lies in focusing less on labels and more on outcomes. As is typical of our approach, ensuring engagement objectives are grounded in evidence-based practices will help us navigate the heightened political challenges characteristic of this period.

In this way we can evolve our strategies to remain effective stewards of long-term value, while staying true to the core purpose of DEI: building better businesses and a more equitable society.

Sustainability Analyst, Foresight Capital Management

Stewardship and Climate Associate

Foresight Capital Management

For further information, please get in touch with your regular Foresight contact or the client team on the details below:

1 https://www.whitehouse.gov/presidential-actions/2025/01/ending-illegal-discrimination-and-restoring-merit-based-opportunity/

2 https://www.reuters.com/sustainability/society-equity/drugmaker-novo-nordisk-drops-gender-representation-requirements-us-2025-05-07/

3 https://www.ft.com/content/c2320415-dcf6-4b69-acd4-3187507d762c

4 Source : AlphaSense https://www.ft.com/content/8e01f7fd-71a2-42ff-b166-5bf9f6177b73

5 John Deere is held in FP Foresight Sustainable Future Themes Fund ("SFT") only.

6 Screenshot from Robby Starbuck’s feed on X taken 25/06/2025

7 https://www.weforum.org/stories/2023/08/heres-where-we-are-in-the-esg-investing-hype-cycle/

8 https://www.theguardian.com/commentisfree/2025/may/26/white-men-terrified-work-advice; https://www.thetimes.com/uk/politics/article/white-men-dei-worries-work-wtd207rn9

9 McKinsey produced research that has been the basis for claims diversity is correlated with improved firm performance has been found to have basic errors https://medium.com/@alex.edmans/is-there-really-a-business-case-for-diversity-c58ef67ebffa. Fortunately, this is resulting in deeper investigations into the links between workforce characteristics and firm performance, for example: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3933687

10 https://www.prnewswire.com/news-releases/national-black-farmers-association-boyd-calls-for-resignation-of-john-deere-ceo-john-may--deere-boycott-302199952.html

11 https://corpgov.law.harvard.edu/2025/04/25/the-evolving-landscape-of-dei-shareholder-proposals/

12 AGM results from Bloomberg

13 https://www.asyousow.org/press-releases/2025/2/25/as-you-sow-withdraws-meritocracy-shareholder-resolution-at-deere

14 As You Sow

15 https://diversityproject.com/wp-content/uploads/2025/06/DP-Cognitive-Diversity-Full-Research-Paper.pdf

16 https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3933687

17 For example, Senate Bill (SB) 2337

18 We have identified the ten companies with the lowest gender diversity at board and senior management level, using data from Impact Cubed (x axis). We have also assessed management’s priority in addressing the topic, indicated by related targets, commitments or goals, talent pipeline plans, disclosure of diversity data, previous engagement responses and supply-chain diversity efforts (y axis). The red dotted line marks the WHEB voting policy’s minimum board diversity threshold; the blue line indicates average female representation at board and senior levels in the WHEB portfolio. Data correct as of July 2024.

Foresight Group LLP does not offer legal, tax, financial or investment advice and the information on this website should not be construed as such. We recommend investors seek advice from a regulated financial adviser. The opportunity described in this document may not be suitable for all investors. Any such investment decision should be made only on the basis of the Fund scheme documents and appropriate professional advice.

Foresight Group LLP acts as investment manager and is authorised and regulated by the Financial Conduct Authority with Firm Reference Number 198020 and has its registered office at The Shard, 32 London Bridge Street, London SE1 9SG.

OEICs

An investment in FP Sustainable Future Themes Fund, FP Foresight Global Real Infrastructure Fund, FP Sustainable Real Estate Securities Fund, FP UK Infrastructure Income Fund or FP WHEB Sustainability Impact Fund and Liontrust Diversified Real Assets Fund (together the “Funds”) should be considered a long-term investment that may be higher risk. Portfolio holdings are subject to change without notice.

The Authorised Corporate Directors FundRock Partners Limited (registered office at Hamilton Centre, Rodney Way, Chelmsford, England, CM1 3BY) and Liontrust Investment Partners LLP (registered office 2 Savoy Court, London WC2R 0EZ), are authorised and regulated by the Financial Conduct Authority with Firm Reference Numbers 469278 and 518552 respectively. The Funds are incorporated in England and Wales.

ICAVs

An investment in the WHEB Sustainable Impact Fund and the WHEB Environmental Impact Fund (together the “Funds”) should be considered a longer-term investment that may be higher risk. Portfolio holdings are subject to change without notice.

The Manager of the Funds is FundRock Management Company S.A., authorised and regulated by the Luxembourg regulator to act as UCITS management company and has its registered office at Airport Center Building, 5, Heienhaff, L-1736 Senningerberg, Luxembourg.

We respect your privacy and are committed to protecting your personal data. If you would like to find out more about the measures, we take in processing your personal information, please refer to our privacy policy, which can be found at http://www.foresight.group/privacy-policy.