Real Assets

We build future energy systems and resilient infrastructure, backing emerging opportunities in technology, land and water.

Real Assets

Private Equity & Ventures

Real Assets

Private Equity & Ventures

We are seeing evidence of increased spending in our portfolio since we introduced a Climate Adaptation thematic as a part of our investment strategy early in 2024.

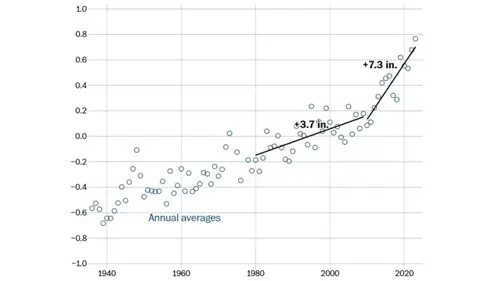

The impact is particularly pronounced at Fort Pulaski, Georgia. Here average sea levels are now nearly 18 inches higher than they were in the 1940s. Nearly two-thirds of that change has come since 1980.

Figure 1: Sea-level relative to the mean at Fort Pulaski, Georgia (1940-2023)1

While the problem is particularly acute at Fort Pulaski, NASA projections show that in the coming decades many cities along the whole eastern seaboard will experience up to 100 more days of high-tide flooding each year2.

The scale and reach of the changes driven by climate change are profound and global. In a ‘visual essay’ another group of journalists has shown how specific cities will feel in the years ahead3. Hollywood in Los Angeles currently has a temperate climate characterized by dry and hot summers. They report, however, that in less than fifty years, Hollywood will feel more like Bollywood with an arid climate that is more akin to New Delhi’s. Closer to home, London will remain temperate but will feel more like Washington DC and Atlanta than it does today.

In some respects, some of these impacts might seem quite positive. As I sit here with temperatures of -1°C outside, temperatures that are on average 2-3 degrees warmer sound quite appealing. The problem is that the effects of climate change are diverse: warmer temperatures also bring more and more intense precipitation and stronger winds among other things. And in cities that are already hot, another 2-3 degrees of warming can move daily activity from uncomfortable to life-threatening.

These impacts are now clearly affecting economics. In Florida, home and flood insurance has become dramatically more expensive, in part due to the risk of more frequent or more intense storms, as a result of climate change. California’s insurance market was already much diminished before the Palisades, Hurst and Eaton fires broke out in early January 20254. The impact of the fires is expected to lead to even less insurance coverage, and without insurance coverage, banks won’t issue mortgages. Globally, losses of US$320bn due to catastrophes including extreme weather in 2024 were 30% higher than the previous year5.

In India, the Asian Development Bank warned in October last year that climate change could hit the country’s GDP by as much as 25% within the next 50 years. A third of India’s GDP is linked to nature-related sectors. Increased frequencies of drought events are already negatively impacting agricultural output. Companies are also citing heat stress as a cause of reduced earnings6.

In Europe, the European Central Bank recently estimated that the heatwave of 2022 caused crop yields to decline in that year, causing food inflation of around +0.6 to +0.7 percentage points7. This impact lasted well into 2023. As the Financial Times has speculated, it is not unlikely that ‘a material proportion of the debate at monetary policy committees will be taken up with discussion of how the economic forecasting model is going to interact with expectations of the next flood or wildfire season’8.

It should not come as a surprise therefore that many companies, communities and even countries are already adapting to the climate change that is now with us and to that which is inevitably yet to come. By some estimates India is already spending more than 5% of its GDP on climate adaptation9.

We are seeing evidence of this increased spending in our portfolio as well. We introduced a Climate Adaptation thematic as a part of our investment strategy early in 2024. Holdings include the Dutch environmental engineering business Arcadis as well as Advanced Drainage Systems, a US-based manufacturer of storm water drainage systems. In recent earnings calls both companies have pointed to demand for their products and services increasing as clients look at adapt to increases in extreme weather10.

Other companies held in the strategy are also seeing growing demand for products and services that help make communities more resilient in the face of a changed climate. This includes demand for efficient cooling systems from Trane Technologies, water treatment and management equipment from Xylem and even fire-fighting equipment from MSA Safety. Most of MSA’s fire-fighting equipment is used in fighting fires in buildings. The company does also supply kit for fighting fires in rural areas – including to fire fighters working to extinguish the Palisades and Eaton fires.

We’ve written before about the increased prevalence of extreme weather that has now become a feature of our lives. But bear in mind that the changes we are currently seeing are associated with global average temperature rises of less than 1.5°C. We can anticipate that the frequency, duration and intensity of these events will be dramatically worse from temperature rises of 2°C or more.

For further information, please get in touch with your regular Foresight contact or the client team on the details below:

1 https://tinyurl.com/3p4whk8a

2 Ibid.

3 https://pudding.cool/2024/06/climate-zones/

4 Seven out of the twelve largest US home insurers have limited their coverage in California over the past two years, in part due to increased fire risk. https://tinyurl.com/a8k7bz7u

5https://tinyurl.com/2m9hz9ey

6 For example, food delivery app Zomato cited heat stress in explaining its lower than expected earnings in 2024. Infrastructure business Larsen & Toubro is shifting working hours to adapt to the impacts of heat on construction workers.

7 https://tinyurl.com/mrxcasmx

8 https://www.ft.com/content/bbf5a2ad-485e-43bd-b130-4cbfdfbfb95e

9 https://www.indiabudget.gov.in/economicsurvey/doc/eschapter/echap06.pdf

10 Ironically Advanced Drainage Systems mentioned hurricanes Helene and Milton as causing disruption to their stormwater business at the end of 2024 but underpinning higher growth in the medium to long-term as clients upgrade their flood management systems.

Foresight Group LLP does not offer legal, tax, financial or investment advice and the information on this website should not be construed as such. We recommend investors seek advice from a regulated financial adviser. The opportunity described in this document may not be suitable for all investors. Any such investment decision should be made only on the basis of the Fund scheme documents and appropriate professional advice.

Foresight Group LLP acts as investment manager and is authorised and regulated by the Financial Conduct Authority with Firm Reference Number 198020 and has its registered office at The Shard, 32 London Bridge Street, London SE1 9SG.

OEICs

An investment in FP Sustainable Future Themes Fund, FP Foresight Global Real Infrastructure Fund, FP Sustainable Real Estate Securities Fund, FP UK Infrastructure Income Fund or FP WHEB Sustainability Impact Fund and Liontrust Diversified Real Assets Fund (together the “Funds”) should be considered a long-term investment that may be higher risk. Portfolio holdings are subject to change without notice.

The Authorised Corporate Directors FundRock Partners Limited (registered office at Hamilton Centre, Rodney Way, Chelmsford, England, CM1 3BY) and Liontrust Investment Partners LLP (registered office 2 Savoy Court, London WC2R 0EZ), are authorised and regulated by the Financial Conduct Authority with Firm Reference Numbers 469278 and 518552 respectively. The Funds are incorporated in England and Wales.

ICAVs

An investment in the WHEB Sustainable Impact Fund and the WHEB Environmental Impact Fund (together the “Funds”) should be considered a longer-term investment that may be higher risk. Portfolio holdings are subject to change without notice.

The Manager of the Funds is FundRock Management Company S.A., authorised and regulated by the Luxembourg regulator to act as UCITS management company and has its registered office at Airport Center Building, 5, Heienhaff, L-1736 Senningerberg, Luxembourg.

We respect your privacy and are committed to protecting your personal data. If you would like to find out more about the measures, we take in processing your personal information, please refer to our privacy policy, which can be found at http://www.foresight.group/privacy-policy.