Real Assets

We build future energy systems and resilient infrastructure, backing emerging opportunities in technology, land and water.

Real Assets

Private Equity & Ventures

Real Assets

Private Equity & Ventures

Managing Partner, Seb Beloe considers how 'energy saved is energy generated' with a focus on Synopsys, a new addition to the WHEB portfolio within our Research Efficiency theme.

Lovins, who bears more than a passing resemblance to the great German physicist, has spent his career advocating for the benefits of energy efficiency.

Lovins has been a life-long advocate of the old adage that ‘energy saved is energy generated’. He popularised the concept of ‘negawatts’. A term used to measure a unit of energy saved and equivalent to a megawatt of power generated.

In spite of Lovins’ efforts, it is still renewables and other low carbon technologies that tend to garner the headlines. But every few decades or so, energy efficiency does briefly take its place in the sun. This happened most recently after Russia invaded Ukraine. This forced electricity prices across Europe to spike by over 200% in the immediate aftermath of the invasion and catalysed frantic efforts to save energy.2 But for the most part, energy efficiency is the rather dull workhorse of the net zero transition. Laudable but unexciting.

However, energy efficiency is due for another stint in the spotlight. This time the catalyst is the vast power consumption of data centres and other technology infrastructure that is powering the AI revolution. This has led to a dramatic increase in demand for power which has in turn driven an uptick in demand for everything from turbines to power transformers. Waiting times for large power transformers are now as long as four years and you won’t get your hands on a new gas turbine until 2032, at the earliest.3

Hyperscalers are so desperate for power that they are even reputed to be considering Amory Lovins’ old trick of looking for ‘negawatts’ by retrofitting homes and offices with heat pumps.4 The idea is that the heat pumps improve the energy efficiency of these buildings and lower their power consumption. The spare capacity that is created can then be redeployed to power data centres.

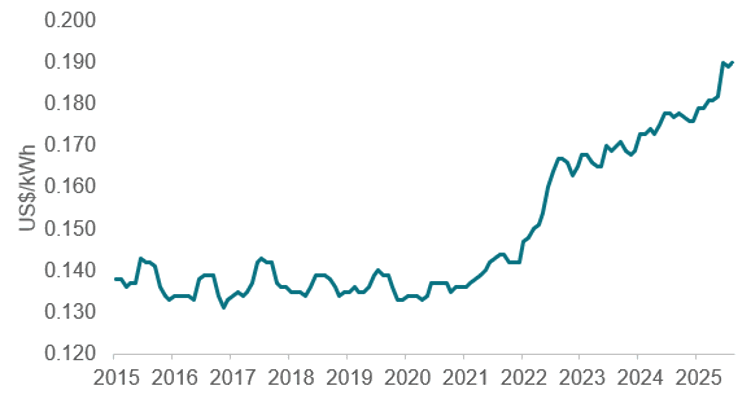

The knock-on effect of all this demand has been to drive electricity prices higher. The average US city electricity price has increased more than 30% on average since 2020 and at almost double the rate of inflation in the past year (see Figure 1 below). Increased power demand for AI is an important contributor to these price increases.

Figure 1: Average US city electricity price (2015-2025)5

As electricity gets more expensive, the return on any investment in energy efficiency could improve. Resource Efficiency is typically one of the two largest thematic areas in the WHEB portfolio. Companies in this theme sell a range of products and services that enable higher levels of resource efficiency for their clients. For example, Trane Technologies provides a suite of efficient heating, ventilation and air conditioning (HVAC) products and services that improve energy use in buildings. Spirax Engineering and Rockwell Automation provide technologies that do the same thing but in manufacturing.

A particular area of focus for the strategy in recent years has been the role that semiconductors play in improving the efficiency of products and of systems. Power Integrations, for example, sells semiconductors that dramatically reduce the power consumption of electrical devices. Silicon Laboratories sells semiconductor chips that allow devices to communicate with each other. This in turn enables huge efficiency gains in networks of devices, for example in automating power management in a network of water pumping stations or in a city’s streetlights.

While these are some examples of semiconductor applications that help to improve energy and resource efficiency, the ubiquity of semiconductors has made the energy efficiency of these products themselves a focus of attention. This has been most evident in the ballooning energy demands of data centres, but also includes data networks, computers and other devices. Together they represent between 1-2% of global greenhouse emissions.6 By some estimates at current growth rates this might be as much as 14% by 20407. Our latest investment, in a business called Synopsys, takes direct aim at this issue by developing a variety of tools to improve the efficiency of semiconductors.

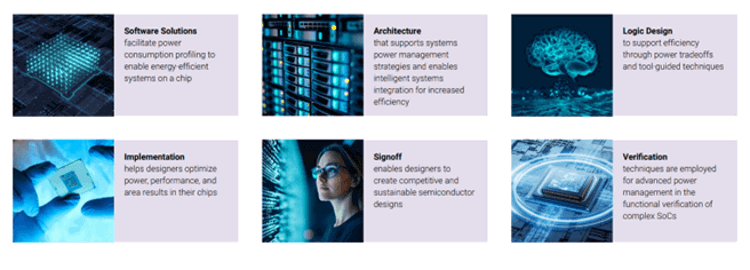

Synopsys is a global leader in electronic design automation (EDA) and develops tools and services to design, verify and manufacture integrated circuits, systems-on-chips (SoCs) and other electronic systems. Energy efficiency is a core part of the proposition offered by the company’s design tools. These include tools for designing, testing and validating low power semiconductors as well as tools for reducing the amount of power needed for the design process itself. Several of their products help to reduce power usage in the design process by up to 50% and are delivering semiconductors with up to 30% improvements in power efficiency with each generation.8 Their customers include major chip designers including AMD, Arm, Nvidia and Qualcomm as well as foundries and device designers.

Figure 2: Synopsys – Driving energy efficient through semiconductor design9

The scale of investment going into AI creates a real risk that the associated greenhouse gas emissions swamp reductions in emissions elsewhere. Improving the energy efficiency of the billions – and soon trillions - of semiconductor chips manufactured every year might still not garner the headlines, but the importance of this work couldn’t be clearer.

Seb Beloe

Managing Director, Head of Research

Foresight Capital Management

For further information, please get in touch with your regular Foresight contact or the client team on the details below:

1 https://rmi.org/people/amory-lovins/

3 https://tinyurl.com/2wpnhsdv and https://tinyurl.com/2t7r3j3x

5 Price data from the Federal Reserve Bank of St. Louis (accessible at https://fred.stlouisfed.org/series/APU000072610).

6 https://ciandt.com/ca/en-ca/article/climate-crisis-and-technology-sector

7 Ibid

8 https://www.synopsys.com/

You have viewed 0 of 0

Foresight Group LLP does not offer legal, tax, financial or investment advice and the information on this website should not be construed as such. We recommend investors seek advice from a regulated financial adviser. The opportunity described in this document may not be suitable for all investors. Any such investment decision should be made only on the basis of the Fund scheme documents and appropriate professional advice.

Foresight Group LLP acts as investment manager and is authorised and regulated by the Financial Conduct Authority with Firm Reference Number 198020 and has its registered office at The Shard, 32 London Bridge Street, London SE1 9SG.

OEICs

An investment in FP Sustainable Future Themes Fund, FP Foresight Global Real Infrastructure Fund, FP Sustainable Real Estate Securities Fund, FP UK Infrastructure Income Fund or FP WHEB Sustainability Impact Fund and Liontrust Diversified Real Assets Fund (together the “Funds”) should be considered a long-term investment that may be higher risk. Portfolio holdings are subject to change without notice.

The Authorised Corporate Directors FundRock Partners Limited (registered office at Hamilton Centre, Rodney Way, Chelmsford, England, CM1 3BY) and Liontrust Investment Partners LLP (registered office 2 Savoy Court, London WC2R 0EZ), are authorised and regulated by the Financial Conduct Authority with Firm Reference Numbers 469278 and 518552 respectively. The Funds are incorporated in England and Wales.

ICAVs

An investment in the WHEB Sustainable Impact Fund and the WHEB Environmental Impact Fund (together the “Funds”) should be considered a longer-term investment that may be higher risk. Portfolio holdings are subject to change without notice.

The Manager of the Funds is FundRock Management Company S.A., authorised and regulated by the Luxembourg regulator to act as UCITS management company and has its registered office at Airport Center Building, 5, Heienhaff, L-1736 Senningerberg, Luxembourg.

We respect your privacy and are committed to protecting your personal data. If you would like to find out more about the measures, we take in processing your personal information, please refer to our privacy policy, which can be found at http://www.foresight.group/privacy-policy.