Real Assets

We build future energy systems and resilient infrastructure, backing emerging opportunities in technology, land and water.

Real Assets

Private Equity & Ventures

Real Assets

Private Equity & Ventures

Sefa Degirmenci explains how real assets are part of a multi-decade infrastructure investment cycle driven by digitisation and the energy transition.

Real assets are a critical element in addressing key strategic objectives for modern economies, whether these be greater connectivity, cleaner energy or more resilient supply chains.

Within real assets, listed infrastructure offers one of the most effective, and currently undervalued, ways for investors to access these long-term growth trends.

Years of underinvestment in developed markets, coupled with rising demand in emerging economies, have created a pressing need to rebuild and expand critical infrastructure. Across our FP Foresight Global Real Infrastructure Fund, portfolio companies have grown capex by roughly 10% per year since 2015, supporting sustained operating earnings growth of around 7% annually from 2018-20241.

For investors, this combination of structural growth and defensive cash flows strengthens portfolio resilience. Within this backdrop, our listed real asset strategies focus on four long-term themes: digitisation, energy transition, demographic change and the infrastructure gap. As digitisation and electrification gain momentum across the industry, they have emerged as important themes for this year’s conference.

While headlines focus on AI models and software breakthroughs, the real enablers of the digital economy include physical assets such as data centres, telecom towers and fibre networks.

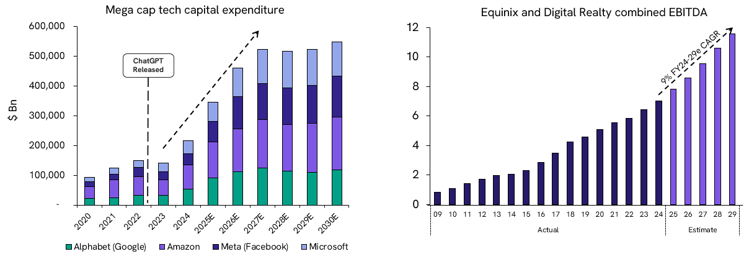

Capex spending by the world’s largest technology companies have grown immensely in recent years, particularly after the launch of OpenAI’s ChatGPT. Yet within our holdings, AI is not acting as the sole growth driver. For companies like Equinix and Digital Realty, around 70–80% of earnings2 still stem from traditional cloud and enterprise services, with AI simply accelerating already-strong demand.

Figure 1: Mega-cap tech capex surge and the rise of data centre profitability3

Telecommunication towers are another quiet beneficiary. Global data usage is set to double over the next five years4, driving sustained demand for tower ‘densification’ as mobile penetration deepens. Tower companies typically generate inflation-linked, long-term lease revenues, providing stable and predictable cash flows through economic cycles. You can read my full article on telecom towers here.

Digitisation is no longer a niche theme. It is a key component of modern economies, and the physical infrastructure behind it is only just entering a new investment cycle.

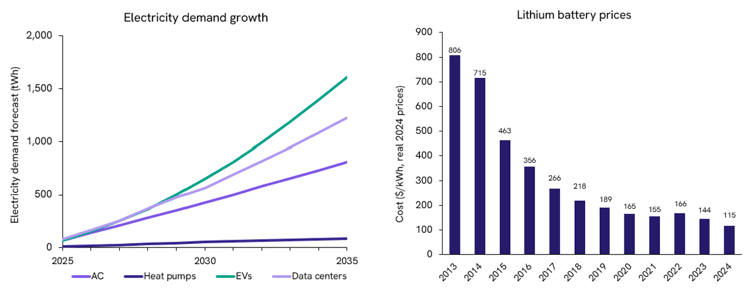

The growth of the digital economy does not happen in isolation. Every data centre, every tower and every AI workload relies on an increasing amount of electricity. In aggregate this translates into dramatic growth in electricity demand. There are also other sources of demand growth. As figure 2 illustrates, electric vehicles (EVs), air conditioning systems and heat pumps are all also contributing to higher levels of electricity demand. As these trends accelerate, so too does the urgency to build a cleaner, more resilient energy system.

Decarbonisation has become a strategic economic priority for governments, including the UK, for three key reasons: energy security, economic competitiveness and affordability, and net zero targets5.

Delivering this electrified future requires coordinated change across four interconnected parts of the energy system. First, generation is shifting away from large fossil-fuel plants to decentralised solar and wind, which are among the most cost-competitive sources of new electricity6. Second, transmission networks face greater pressure, requiring substantial investment to connect new renewable capacity to where demand is growing. Third, consumption is set to accelerate, with UK forecasting demand growth of approximately 30% by 20357. And fourth, flexibility and storage will be critical, with batteries shifting low-cost daytime solar into the evening peak and reducing reliance on fossil-fuel generation.

As demand grows, the central challenge is to balance a system where both renewable supply and electricity demand fluctuate significantly. Wind and solar are fast and cheap to deploy, but their intermittency due to fluctuating environmental conditions means evening peaks are still met largely by gas generation. This remains costly, carbon-intensive and leaves the system exposed to global gas markets.

The solution is flexible technologies like battery storage, which shift excess daytime renewable power into the evening. By storing electricity when prices are low and discharging when demand is high, batteries reduce reliance on gas plants and help smooth price volatility.

Figure 2: Global electricity demand growth and the fall in lithium battery prices8

For years, critics argued that batteries were too expensive to scale. A decade ago, the numbers justified the scepticism with a lithium-ion battery costing around $800 per kWh. Today, costs have dropped to just $1159 per kWh, making utility-scale batteries economically viable for the first time.

Deployment is accelerating as a result. Several listed companies within our investment universe are positioning themselves as leaders in the supply of battery energy storage. Clearway Energy and Brookfield Renewables, for example, are rapidly growing their US storage pipelines, while Spain’s Grenergy is acting as a first mover in battery deployment across Latin America and Europe. Grenergy expects to scale from virtually 0 MWh of operational storage today to around 18 GWh by 202810 - enough to support over 2 million average European homes for a day and in turn driving substantial, recurring earnings growth for the company.

Digitisation and electrification are not future concepts, they are unfolding now and reshaping the physical foundations of the global economy. At the heart of this transition sit infrastructure assets that are not optional, but essential, providing the critical systems that enable societies and industries to function. Listed real asset businesses stand to benefit directly, supported by asset-backed cash flows, inflation linkage and long-term visibility.

With valuations at multi-year lows despite strengthening fundamentals, we believe listed infrastructure offers one of the most compelling opportunities available to equity investors today.

Sefa Degirmenci

Investment Associate

Foresight Capital Management

For further information, please get in touch with your regular Foresight contact or the client team on the details below:

1 Source: Bloomberg (GRIF portfolio weighted capital expenditure as at August 2025).

2 Source: Equinix and Digital Realty Company Reports & Presentations.

3 Source: Bloomberg & Individual Company Reports.

4 Source: Ericsson Mobility Report, 2025.

5 Source: The UK’s Plans and Progress to Reach Net Zero by 2025, 2025.

6 Source: Lazard’s Levelized Cost of Energy+ Report, 2025.

7 Source: National Energy System Operator (NESO), 2025.

8 Source: BNEF (New Energy Outlook, 2025).

9 Source: BNEF (https://about.bnef.com/insights/commodities/lithium-ion-battery-pack-prices-see-largest-drop-since-2017-falling-to-115-per-kilowatt-hour-bloombergnef/).

10 Source: Grenergy Capital Markets Day Presentation, 2025.

Foresight Group LLP does not offer legal, tax, financial or investment advice and the information on this website should not be construed as such. We recommend investors seek advice from a regulated financial adviser. The opportunity described in this document may not be suitable for all investors. Any such investment decision should be made only on the basis of the Fund scheme documents and appropriate professional advice.

Foresight Group LLP acts as investment manager and is authorised and regulated by the Financial Conduct Authority with Firm Reference Number 198020 and has its registered office at The Shard, 32 London Bridge Street, London SE1 9SG.

OEICs

An investment in FP Sustainable Future Themes Fund, FP Foresight Global Real Infrastructure Fund, FP Sustainable Real Estate Securities Fund, FP UK Infrastructure Income Fund or FP WHEB Sustainability Impact Fund and Liontrust Diversified Real Assets Fund (together the “Funds”) should be considered a long-term investment that may be higher risk. Portfolio holdings are subject to change without notice.

The Authorised Corporate Directors FundRock Partners Limited (registered office at Hamilton Centre, Rodney Way, Chelmsford, England, CM1 3BY) and Liontrust Investment Partners LLP (registered office 2 Savoy Court, London WC2R 0EZ), are authorised and regulated by the Financial Conduct Authority with Firm Reference Numbers 469278 and 518552 respectively. The Funds are incorporated in England and Wales.

ICAVs

An investment in the WHEB Sustainable Impact Fund and the WHEB Environmental Impact Fund (together the “Funds”) should be considered a longer-term investment that may be higher risk. Portfolio holdings are subject to change without notice.

The Manager of the Funds is FundRock Management Company S.A., authorised and regulated by the Luxembourg regulator to act as UCITS management company and has its registered office at Airport Center Building, 5, Heienhaff, L-1736 Senningerberg, Luxembourg.

We respect your privacy and are committed to protecting your personal data. If you would like to find out more about the measures, we take in processing your personal information, please refer to our privacy policy, which can be found at http://www.foresight.group/privacy-policy.