Real Assets

We build future energy systems and resilient infrastructure, backing emerging opportunities in technology, land and water.

Overall, we are pleased with our progress in delivering strong impactful investments and augmenting this with our engagement work which we will detail in the next section.

On the performance side, we delivered again a positive absolute return but are disappointed by its size especially when compared to the wider market. We will provide reasons for this and detail what went well, and what didn’t.

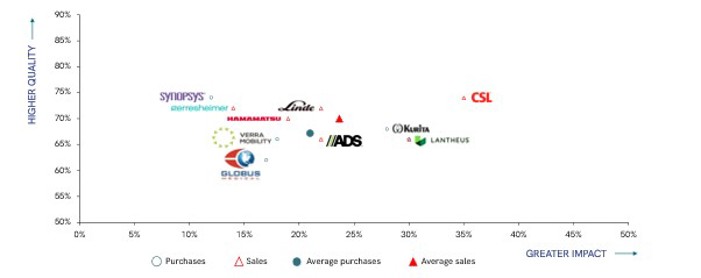

We always strive to add more impactful quality names to the strategy. However, there is obviously a limit to that and we would never replace a portfolio holding simply for the sake of a larger impact if this didn’t go hand-in-hand with a higher risk-adjusted return expectation. After four consecutive years of increasing the average portfolio quality and impact to record levels of around 71% and 25% respectively2, we were not surprised that our portfolio trades during the review period (see chart below) nudged the impact and quality down slightly by less than a percentage point.

Figure 1: Portfolio impact and quality evolution in 2025

Source: WHEB. Transactions cover AIC 2024 to AIC 2025 (28/11/2024 -27/11/2025), 5 purchases and 6 sales for the FP WHEB Sustainability Impact Strategy.

Evaluating the impact of our holdings is only one aspect of our commitment to deliver impact. We also aim to advance impact through our stewardship and engagement work. There are three levers of influence that we use to achieve this:

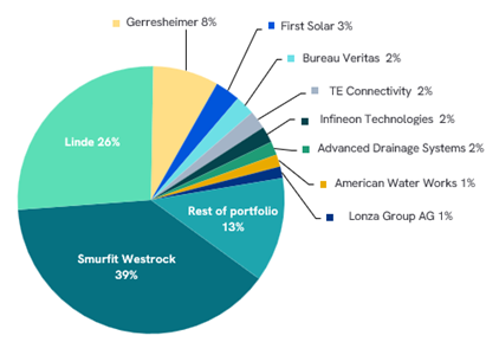

We evaluate each company bottom-up and prioritise our engagement based on the materiality for each company. Let’s take a practical example of one of the most important topics: Advancing climate action in order to be aligned with the COP21 Paris Agreement of 2015. The 10 largest CO2 emitters in our portfolio account for 87% of total emissions so these are the companies we want to engage with primarily on this topic.

Figure 2: Prioritising action: share of emissions across our portfolio

This is of particular importance to us since we are committed to having 100% of our portfolio emissions covered by net zero carbon targets by 2028 – we are 98% there already!

The fourth largest carbon emitter in our portfolio is First Solar which is somewhat ironic given its products (solar panels) are absolute key in decarbonising the global economy. In terms of “Influencing companies” we have been in active engagement with First Solar since 2021. Our principle objective is to encourage the company to achieve its targets to source 100% of its own electricity needs from renewable sources by 2028 (which slipped from 2026). An agreement during the year to source 70% of its electricity needs for its Indian operations was a big step in the right direction.

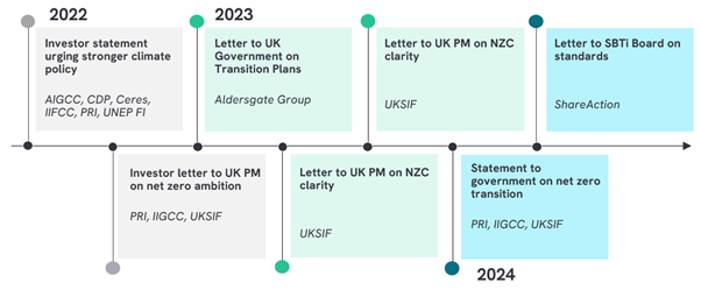

We are also actively pursuing the second lever – “Influencing the system” – in order to encourage industry-wide and policy-level support that will enable companies to set and achieve ambitious climate targets, including First Solar. As the diagram below shows, we have been participating in coalitions, engaged with policymakers and supported numerous initiatives throughout the years.

Figure 3: Macro stewardship activities by WHEB / Foresight

The third lever is about “evidencing real-economy progress” and we are collecting data to evaluate whether companies are living up to their promises and are on track for their stated targets. In the case of First Solar, their rapid manufacturing expansion which has quadrupled their production of solar modules has resulted in their scope 1+2 emissions increasing by 67% since 20213. Our engagement on this topic remains in full flow.

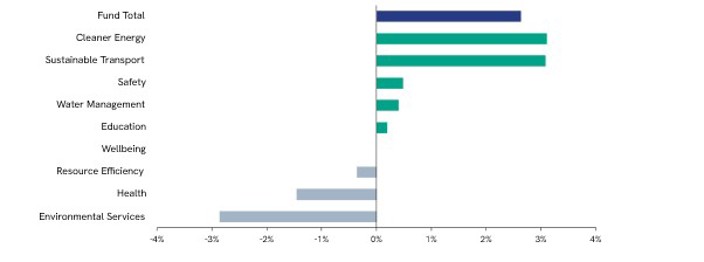

Moving on to investment returns, we achieved a positive absolute performance in 2025 of 2.6% primarily driven by strength in the Cleaner Energy and Sustainable Transport themes. Meanwhile Health and Environmental Services were the greatest detractors.

Figure 4: One year theme contribution to return

Source: FactSet, WHEB defined Themes. Contribution from AIC 2024 (28/11/2024) to 14/11/2025.

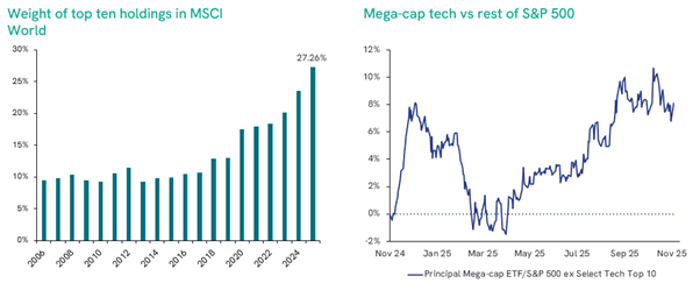

This performance was lagged the wider market which in itself might be a misnomer – the market narrowness due to mega-cap tech stocks is at unprecedented levels. The weight of the top ten holdings in the MSCI World is above 27% in 2025. Historically, the top ten amounted to around 10%.4 And due to recent developments in AI, these mega tech-caps have performed extraordinarily strongly and were the main contributor to the strong performance of the MSCI World index. While this made a tough comparison for 2025, there are some supportive implications for our environmentally-focused themes.

Figure 5: Mega-cap stocks drive the vast majority of stock market gains

Source: Bloomberg, Factset. Past performance is not a reliable guide to future results.

Cleaner Energy has been our strongest theme in 2025 despite broader market expectations influenced by U.S. policy developments. Nonetheless, energy demand growth has been very strong in 2025 driven by demand for artificial intelligence (AI) as well as adoption of electric vehicles (EVs). EV adoption, while taking place more slowly than originally anticipated, has still exceeded 20% every year since 20225 and this underpinned strong performance in our Sustainable Transport theme this year. Energy demand is also growing due to wider changes to electrify other aspects of modern life including heating (using heat pumps) and cooling (through greater use of air conditioners). Only renewable energy sources, especially solar, can be built out rapidly enough to support the current demand growth and that is visible in the rapidly growing order backlogs of our holdings Nextpower and First Solar as well as Vestas (in wind) over the past 3-4 years.

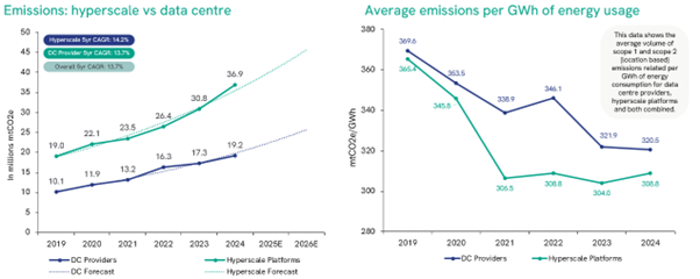

Renewable power generation is not the only opportunity supported by the strong growth in data centre demand. The push for higher energy-efficiency along the entire data centre ecosystem is creating opportunities for numerous of our holdings: efficient cooling (e.g. Trane), faster and less power-hungry connectivity (e.g. TE Connectivity), and smart equipment and buildings (e.g. Schneider Electric) all enable lower carbon emissions per GWh of energy usage and are in strong demand.

Figure 6: Data centre emissions are rising

Source: Structure Research, 2025 State of Environmental Impact, Data Centre Providers % Hyperscale Platforms, February 2025. Values represent data from ESG Leaders, as defined by Structure Research

However, other industrial sectors have continued to struggle in 2025 and our holdings in these sectors make up a large part of our weakest-performing theme, Environmental Services. The purchasing managers manufacturing index (PMI), a key indicator of broad industrial demand, flat-lined in Western countries for most of 20256. Over time, we expect to see rising AI-related capex spend positive impact broader industrial activity and are hopeful that a recent modest uptick in the PMI presages a better 2026.

The healthcare theme had a pretty miserable year with the sector suffering from the largest cash outflows over the past 12 months (measured in ETF flows)7. Policy developments in the U.S. have influenced market dynamics during this period. U.S. healthcare names have been put under pressure from a four-fold onslaught:

In particular our drug discovery companies (e.g. ThermoFisher, Agilent, Danaher) suffered strongly during the first half of the year. As the year progressed however, the market realised that “TACO”8 also applies at least in part to uncertainty around healthcare policy and a partial recovery set in also helped by a stabilisation in Biotech funding. We see opportunities emerging from innovative drug therapies (e.g. cell and gene therapies) which could create a whole new ecosystem into which many of our healthcare holdings could sell. Similarly, a reshoring trend of pharma production will create demand for new bioprocessing and life sciences equipment and tools. The other huge innovation opportunity is obviously coming from AI which many of our holdings are already embracing and making strong use of, be it in research and drug discovery by ICON or in advanced analytics of patient data by Siemens Healthineers. We remain optimistic for the healthcare space which benefits from one of the most powerful megatrends: a continually aging population.

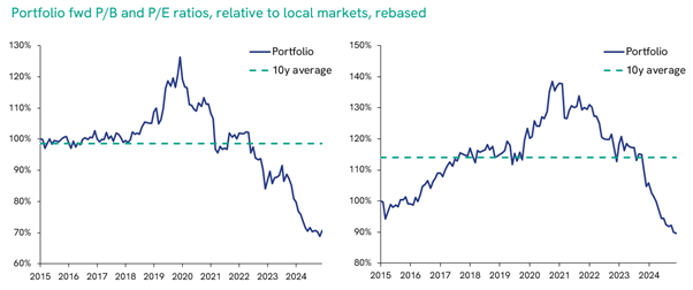

The WHEB strategy continues to exhibit substantial valuation dislocation vs local markets (in our view) compared with historic levels of commonly used valuation measures such as price to book (P/B) or price to earnings (P/E) ratios. We are convinced that this sharp discount is unjustified and will correct offering a clear investment opportunity.

Figure 7: Valuation is still very supportive

Source: FactSet as of 31/10/20259. Past performance is not a reliable guide to future results.

We see three potential important positive catalysts to narrow the valuation gap in the coming year:

In the wake of changes in U.S. leadership last November, the pendulum has swung strongly away from sustainability but this does not mean that the urgency for action has diminished in any way. Quite the opposite – sustainability challenges are more urgent than ever. For example, according to research by Carbon Action the world is “on track” to warm by at least 2.1°C based on current policies10. As a result, water scarcity becomes an ever more pressing issue. Around 25 countries with 25% of the world’s population are exposed to extremely high levels of water stress, a number that is predicted to rise significantly by 2050.11

We at Foresight believe that the pendulum will soon swing in the right direction again and are positioned for the next industrial revolution which is in the making – a green industrial revolution.

Ben Kluftinger

Senior Manager, Investments

Foresight Capital Management

Foresight Group LLP does not offer legal, tax, financial or investment advice and the information on this website should not be construed as such. We recommend investors seek advice from a regulated financial adviser. The opportunity described in this document may not be suitable for all investors. Any such investment decision should be made only on the basis of the Fund scheme documents and appropriate professional advice.

Foresight Group LLP acts as investment manager and is authorised and regulated by the Financial Conduct Authority with Firm Reference Number 198020 and has its registered office at The Shard, 32 London Bridge Street, London SE1 9SG.

OEICs

An investment in FP Sustainable Future Themes Fund, FP Foresight Global Real Infrastructure Fund, FP Sustainable Real Estate Securities Fund, FP UK Infrastructure Income Fund or FP WHEB Sustainability Impact Fund and Liontrust Diversified Real Assets Fund (together the “Funds”) should be considered a long-term investment that may be higher risk. Portfolio holdings are subject to change without notice.

The Authorised Corporate Directors FundRock Partners Limited (registered office at Hamilton Centre, Rodney Way, Chelmsford, England, CM1 3BY) and Liontrust Investment Partners LLP (registered office 2 Savoy Court, London WC2R 0EZ), are authorised and regulated by the Financial Conduct Authority with Firm Reference Numbers 469278 and 518552 respectively. The Funds are incorporated in England and Wales.

ICAVs

An investment in the WHEB Sustainable Impact Fund and the WHEB Environmental Impact Fund (together the “Funds”) should be considered a longer-term investment that may be higher risk. Portfolio holdings are subject to change without notice.

The Manager of the Funds is FundRock Management Company S.A., authorised and regulated by the Luxembourg regulator to act as UCITS management company and has its registered office at Airport Center Building, 5, Heienhaff, L-1736 Senningerberg, Luxembourg.

We respect your privacy and are committed to protecting your personal data. If you would like to find out more about the measures, we take in processing your personal information, please refer to our privacy policy, which can be found at http://www.foresight.group/privacy-policy.